Card Services

Having problems with your debit card? If you are having issues with your Welch State Bank debit card please contact us at any location during business hours.

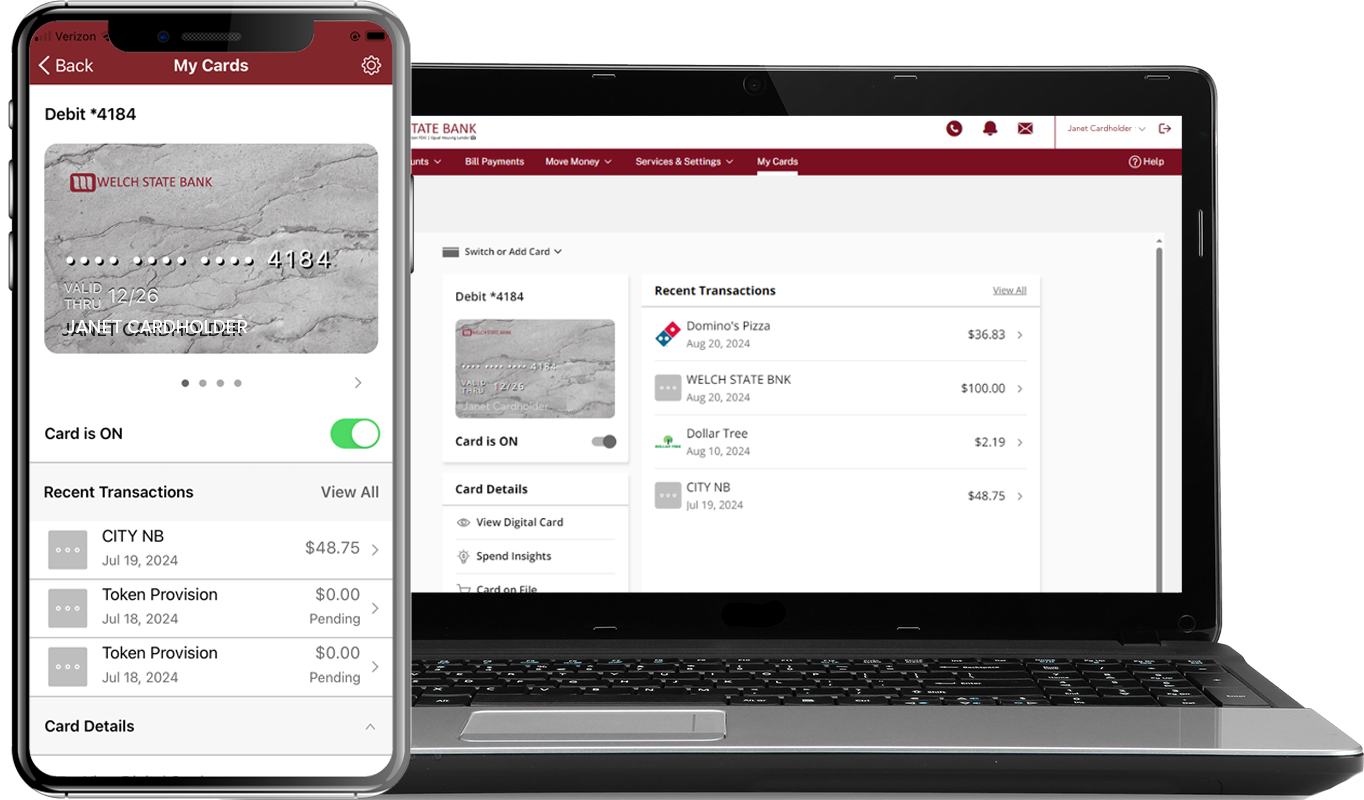

My Cards: You can also use your My Cards feature in your or Mobile Banking app or Online Banking account to report a card lost or stolen, reset your PIN, and much more! Read more about My Cards below.

After Banking Hours? Please use these numbers to contact a representative 24/7 to assist you!

- First time PIN Setup & PIN Change: Please call 800-992-3808

- Lost/Stolen or Questions regarding your card: Please call 833-225-7130

- Fraud or non-Fraud dispute: Please call 833-225-7131

Start Enjoying the surcharge-free benefits of the MoneyPass ATM Network today!

For as hard as you work for your money, you shouldn’t have to throw it away on surcharge fees. We offer you access to the MoneyPass ATM Network.

Easily find convenient ATMs at moneypass.com or the mobile app.

Control Your Debit Card with My Cards in your WSB Mobile Banking app