We take pride in putting your individual banking needs first with friendly, knowledgeable, and personal service. We want to help you meet your financial goals and we’ll be with you every step of the way – and we’re always just a phone call away.

At Welch State Bank you are sure to find the best account(s) and services for you. We want to be your bank!

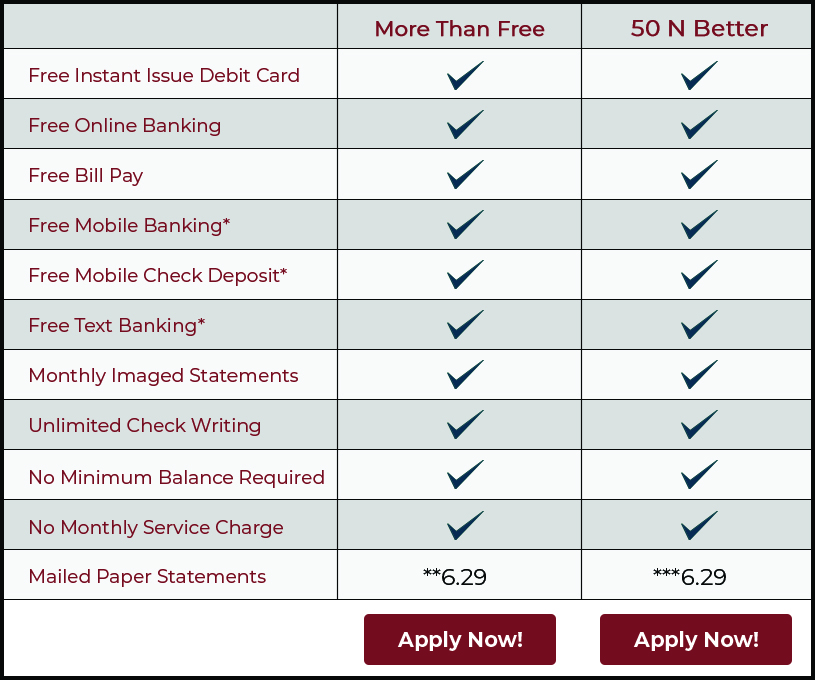

Checking Accounts

We understand your checking account should be convenient, safe, reliable, and come with the services you need.

Banking Features

We make it easy to Bank Like You with our Free Services. Secure Online Banking, Mobile Check Deposit, Electronic Statements, and much more!

Personal Loans

Finding the right loan to meet your needs can be difficult. We’re here when you need us, and have been since 1923, offering various options for your lending needs.

No matter where you are in life, Welch State Bank has a checking account made just for you!

All Welch State Bank checking accounts come with free services! Free online banking – free bill pay – free mobile banking – free mobile check deposit.* Select an account to learn more.

Our More Than Free Checking account has no monthly service fees! This account is interest bearing with unlimited transactions and no minimum balance requirement.

Our Your Choice Checking is interest bearing with unlimited transactions and no minimum balance requirement. This account has small $6.29 monthly service fee to receive paper statements by mail.

Our 50 N Better Checking account is specially designed for those 50 years of age or better. Making it even better, this account is an interest-bearing account with UNLIMITED check writing and 2 FREE Boxes of Bank Checks per year.

*A $6.29 monthly service will apply for mailed paper statements.

Our Tiered Interest Checking account is designed for those who maintain a higher daily balance. This account earns interest on a tiered basis – so the higher the balance, the more interest you earn! Plus, you have unlimited check writing and monthly images statements.

$1,500 minimum balance requirement to avoid monthly $6.00 service charge during statement cycle

Our Money Market Account gives you the ability to write a limited number of checks and still earn interest on a higher payout tier.

A $1,500.00 minimum balance to open and required to maintain in order to receive APY. $15.77 Monthly Service Fee is balance falls below $1,500 during the monthly statement cycle. Limited to 6 transactions items per statement cycle. Over the Counter transactions are unlimited. $10.00 excessive fee after 6 withdrawals per month.

*Third-Party Data, Messaging, or ISP Fees may apply.

Not sure which checking account is right for you?

Personal Savings

We have savings account options for everyone, no matter your savings goals. Whether you are new to savings or an experienced saver, enjoy the wide range of benefits from our Savings Account options from Welch State Bank.

Personal Investments

Achieve your personal financial goals. We offer competitive rates on CDs, CDARS and ICS services, and Individual Retirement Accounts (IRA) to set yourself up for retirement success.

Credit Cards

Choosing the right credit card is easier than ever. Whether you want to pay down balances faster, maximize cash back, earn rewards or begin building your credit history, we have the card for you!

Banking FAQs – Help by Product

We currently offer a variety of checking accounts so you can chose what best fits your needs. Click here to use our account selector to see what WSB checking account is best for you!

All Welch State Bank checking accounts come with free services! Free online banking, free bill pay, free mobile banking, and free mobile check deposit.

*Third Party Data, Messaging, or ISP fees from your phone provider may apply.

Our checking accounts have a $50 minimum deposit to open.

Yes, we can open personal checking accounts online. Please visit our homepage and click the “Open an Account” or click here, to submit your information to a New Account Representative.

There are no monthly service fees with our More Than Free Checking account! With this account you also receive free services, unlimited transactions, and there’s no minimum balance requirement.

*eStatements required. If you would like to have mailed paper statements, a $6.29 monthly service charge will apply.

Look at the bottom of your checks. The first nine-digit number on the left is the ABA routing number or bank routing number. Just to the right of the routing number is your account number.

Our routing number is 103104942. You can also find it at the top of our website banner.

There are a few ways you can request an order of Welch State Bank Checks for your account.

- You can order checks by calling any branch location and requesting an order

- Login to your Online Banking and request an order by clicking “Welcome ” the click, “All Services & Settings” Then under Quick Links click to submit a request to “Reorder Checks”

- Or you can email help@www.welchstatebank.com and we will contact you to complete your order.

The cost varies by type of account, quantity, and style of checks. Please call or visit any branch location for more information.

Yes! We offer Overdraft Privilege on our Checking accounts. Please call or visit any branch location for more information.

*This privilege is contingent upon credit approval.

Yes, we can open a personal savings accounts online. Please visit our homepage and click the “Open an Account” or click here, to submit your information to a New Account Representative.

No! There is not a monthly service charge for our savings accounts. However, there is limited monthly withdrawals. Any withdrawals over 3 per month will accrue a $2.29 service fee per withdrawal.

Yes. You may withdraw from your savings account at any time. You may even transfer funds from your Online Banking/Mobile App.

However, our savings account has limited withdrawals. You may have 3 withdrawals/transfers per month at no charge. After the third withdrawal/transfer transaction a $2.29 charge per withdrawal/transfer transaction fee will apply.

You may deposit as many times as you would like to your savings account. You may even transfer funds from your Online Banking/Mobile App.

However, our savings account has limited withdrawals. You may have 3 withdrawals/transfers per month at no charge. After the third withdrawal/transfer transaction a $2.29 charge per withdrawal/transfer transaction will apply

You begin earning interest on the day the account is opened. Interest will continue to accrue as long as a daily balance of $50.00 is in the savings account.

Interest is paid quarterly.

We do! Our Little Savers Savings Account is perfect for kiddos Birth to 12 years old, and it’s only $5.00 to open! It’s interest bearing and there’s no dormant fee.

Yes, we can open personal checking & savings accounts online. Please visit our homepage and click the “Open an Account” icon or click here, to submit your information to a New Account Representative. Once submitted a New Account Representative will contact you to complete the account opening process.

We offer competitive rates and terms from 30 days to 5 years to meet your savings needs. Please call or visit any branch location for current CD rates and to open your certificate of deposit.

Yes, we can start the loan pre-qualification process right from our website. Please visit our homepage and click the “Loan Pre-Qualification” icon or click here, to submit your information to a Loan Officer. Once your inquiry is submitted a Loan Officer, of your choice, will contact you as soon as possible.

If you would like to add someone to your account, please contact any branch location for more information. We have multiple ways we can complete this request for you.

A POD, also known as, Payable on Death, is someone you will designate at account opening to receive the funds from your account upon all owners death. The POD does not have access to your account while owners are living, and cannot receive information. It is simply a designation of who the funds will go to after all owners on the account are deceased.

*This definition is defined by Welch State Bank’s policies and procedures for POD(s) associated with our account types.

A POA, also known as, Power of Attorney, is a legal authorization that gives a designated person, termed the agent or attorney-in-fact, the power to act for another person, known as the principal. The agent may be given broad or limited authority to make decisions about the principal’s property, finances, investments, or medical care.

These documents are completed from an attorney’s office or at state level to confirm the POA for the principal. Once the principal is deceased, the POA is null and void, allowing the rights that were, no longer valid.

*This definition is defined by Welch State Bank’s policies and procedures for POD(s) associated with our account types.

Your Access ID & Passcode will be the same for both Online and Mobile Banking. You only have to enroll once.

- Visit our website at welchstatebank.com.

- Click the “Log In” box from the top right hand corner, then click “Apply Now”

- Next, simply complete the enrollment form and submit.

Your Access ID & Passcode will be the same for both Online and Mobile Banking. You only have to enroll once.

- First, make sure you have the WSB Mobile app downloaded to your phone.

- Once downloaded, you can “Enroll Now” from the home screen. This will direct you to complete the enrollment form and submit.

To recover your password, go to the Log In area on welchstatebank.com and click “Forgot Password”. On your mobile app, you can do so by tapping “Forgot Passcode” on the home screen. You will need your account number to complete the password reset.

Mobile check Deposit can be activated upon request, and approval. Please call or visit any branch location for more information.

Once you’ve signed in to Online Banking, you can access your account statements in a couple different ways:

- Got to welchstatebank.com, tap the Log In box and enter your username and password.

- From there you will tap the account you wish to view statements from, and tap the statements link on the right hand side.

- You will then be redirected to view your statements for the account you selected.

We currently do not have a way to view your eStatements from the mobile app. To view eStatements from your mobile device, please go to your phones browser, then to welchstatebank.com.

- Next you will tap the Log In box and enter your username and password.

- From there you will tap the account you wish to view statements.

- Then tap the ‘statements’ link on the right hand side.

- You will then be redirected to view your statements for the account you selected.

There are a few ways you can access your balance.

Online Banking

Sign in to Online Banking and enter your username and password. Once signed in, your account balances will be available online.

Mobile App

View account balances, transactions, transfer money from you mobile app.

Branches

Call or visit any branch location to view your account balance(s)

Online Banking

Log In to your online banking account. Once signed in, click the “Bills & Payments” tab from the top banner menu. You can add, create, and see pending and recent payments from this screen.

Mobile App

Log In to your mobile app. Then tap the Bill Pay icon at the bottom of the screen. You can pay previous or add new Bill Payees from the top right hand corner.

We currently do not have the ability to add/setup new external account(s) from our Mobile App. Once an account has been setup and verified, transfers can be initiated from our Mobile App.

First, we will need to setup the account you would like to use for external transfers, and verify, before we can create the first and following transfers.

- Log in to your Online Banking account via our website from your mobile browser or a desktop/laptop device.

- Once you are logged in, from the homepage you will tap the “Welcome ” drop down and then tap ‘All Services & Settings’

- Next, tap ‘Add External Transfer’ and agree to the ‘Terms and Conditions’

- Now you will setup all the external account info, and if this account can be used to transfer, To & From as well as the transfer maximum’s.

- Once complete you will then tap Submit.

Once the request is submitted you will need to watch your account for the micro-deposits. Loans will not have micro deposit verification.

Once your micro-deposits are posted, you will log in to your Online Banking account to verify the amounts.

- Log in to your Online Banking account via our website from your mobile browser or a desktop/laptop device.

- Once you are logged in, from the homepage you will tap the “Welcome ” drop down and then tap ‘All Services & Settings’

- Next, tap ‘below ‘Add External Transfer’ and tap ‘Validate external account(s)’

- Then enter the micro deposit amount to validate.

When this is complete the account will be attached and ready to create your transfer via your Online Banking account and your Mobile App.

To report your card lost or stolen please call: 1-833-225-7130. You may also call or visit any branch location.

You may call or visit any branch location for further assistance, or call: 1-833-225-7131 to report fraudulent charges on your debit card.

Before you leave on your trip, please contact any branch location to let them know where you will be traveling and when. We will update your card with your travel dates and destinations. This will assist our fraud department in knowing you are traveling and to not be suspicious of transactions during that time and location.

We monitor your debit and credit activity, and may place holds on your cards if we suspect fraudulent activity. Notifying us in advance of travel helps us to better determine if activity on your account is suspicious or not.

Enjoy the surcharge-free benefits of the MoneyPass ATM Network. To easily find convenient ATMs at moneypass.com or the download the mobile app.

A certificate of deposit (CD) is similar to a savings account. Money is deposited in a CD at a fixed interest rate and must remain there for a specific term that you choose. The term can be from 30 days to 5 years.

You can open with as little as $500.

We offer competitive rates and terms from 30 days to 5 years to meet your savings needs. Please call or visit any branch location for current CD rates and to open your certificate of deposit.

Penalties may apply to withdrawals made at any other time than during the grace period or maturity if the CD. Call or visit any branch location for specific penalties for your withdrawal.

*Early withdrawal penalty fees could reduce earnings on the account.

Before your CD matures we will send a notice to remind you of your maturity date, along with your current balance, current rate, and interest accrued.

At that time you can decide to withdraw all or part of the money, have it automatically renew for the same CD term at the interest rate that is being offered at maturity, or roll it over into a new CD term at the interest rate that is being offered at maturity. You can make a change on your maturity date or up to 10 days grace after your maturity date.

Yes, please call the number on the back of your card. If your card’s been lost or stolen, call 1-800-558-3424.

We offer a variety of credit cards with different rates and benefits. Whether you want to pay down balances faster, maximize cash back, earn rewards, or begin building your credit history, we have the card for you! Click here to view our credit card options.

You can apply online, right from our website. Click here to view credit card options and apply now.

*Credit decisions are made by a third party vendor, Elan Financial Services.

Applying online can be done in just a few easy steps that take about 15 minutes. The application process is easy, convenient and secure.

That will vary depending on the loan type you are requesting, but it’s easy to get the process started! Click here, to submit your information to a Loan Officer. Once your inquiry is submitted a Loan Officer, of your choice, will contact you as soon as possible.

It’s easy to apply. You can start the loan pre-qualification process right from our website. Click here, to submit your information to a Loan Officer. Once your inquiry is submitted a Loan Officer, of your choice, will contact you as soon as possible.

We have multiple ways you can make your Welch State Bank loan payment. You will receive loan payment coupon book after your loan is processed. You may mail in a payment from your loan booklet, visit any branch location, or call any branch location to make a payment over the phone.

When completing your loan documents we can have this information ready to go with your signature to complete.

If you have a loan and wish to now utilize automatic payments from your WSB account to your WSB loan, we can have this prepared for your signature. If your WSB loan is here and your account is at another financial institution, we can also complete this request. Please call any branch location to complete.

To change your payment due date on your loan, we will need to proceed with your loan officer. If you do not know who your loan officer is, that’s okay. Call any branch location and we will be able to get you with the right person.

Our current loan rates vary deposing on the type of loan you are requesting. Please contact a loan officer at any branch location to discuss further.

Our officers are equipped with the power to make quick decisions. Depending on the type of loan you are requesting, most decisions can be made same day.

Please call any branch location and we will direct you to loan officer for more information, or click here, to submit your information for a loan pre-qualification. Once your inquiry is submitted a Loan Officer, of your choice, will contact you as soon as possible.

We have multiple ways you can make a principal payment. You may mail in a principal payment, visit any branch location, or call any branch location to make a principal payment over the phone.

To defer a payment on your loan, we will need to proceed with your loan officer. If you do not know who your loan officer is, that’s okay. Call any branch location and we will be able to assist with your request and get you with the right person.

You may call any branch location to complete his request. Depending on your loan type this request may be submitted to another department to complete.

Once you have received your loan payoff amount, you can mail in your payoff, visit any branch location, or call any branch location to make your payoff over the phone. (over-the-phone payoff transactions depends on the loan payoff amount) Call any branch for more information.

Our loan officers are here to help with a loan pre-qualification so you can house shop with confidence. Use this calculator to help.

Don’t forget, when calculating your mortgage budget, you need to take into account homeowners’ insurance and property taxes. Those will both affect your budget monthly. If you are unsure of local property taxes, reach out to your real-estate agent with questions.

Certain loan programs have minimum credit score requirements, however others do not. Our officers will pull credit at your loan request before a credit decision is made, however, there are other qualifying factors our officers will take into consideration for your credit decision.